How to Avoid Budget Burnout

Minute Read

Beat budget burnout and focus on what’s important with these 7 simple tips.

- Change your budget system. Looking at other budgeting options such as the 50/30/20 rule could help you get out of your budgeting funk. This system allows you to break your budgeted money up into percentages with 50% going to “needs,” 30% going to “wants,” and 20% going to your future financial goals. Setting up a plan will help you meet your short-term and long-term goals in a more effective way.

- Reevaluate your financial goals. Sometimes, conquering budget burnout is as simple as changing your financial perspective. Ensure you’re putting value on what truly means the most to you and your future. Develop your financial goals and stick to them to stay on budget for success. Oftentimes it’s difficult to see the big picture and save appropriately for larger long-term goals. If you find yourself feeling burnt out with your budget, try to incentivize your saving. Create rewards for milestone saving goals and simple short-term goals. This way, there will be variety in your saving and spending habits, which will keep you engaged with your budget.

- Find extra money in your necessities. Rather than removing all fun things from your budget, look for ways you can reduce expenses in your everyday life. Consider finding a roommate to help share expenses or downsizing to a smaller or less expensive place. You could also cut back on your energy use at home, meal prep instead of eating out, or refinance your mortgage or vehicle loans.

- Consult your resources. Enlisting the help of a friend, family, or outside resource may be the adjustment you need to better your budget. Ask for help from a friend, spouse, or family member and see if they have any tips or financial background that could help you. From there, consider consulting outside resources such as digital banking and learn more information about accessible financial tools anytime, anywhere. Consider reaching out to your concierge, your go-to person for financial education.

- Share your budgeting responsibilities. Managing your household budget alone can feel overwhelming. If you share finances with your partner, ask them to help develop your budget as a couple. While talking to your partner about money can feel intimidating, it can help improve communication and give you someone to bounce numbers and ideas off. Just ensure your partner is detail and deadline-oriented so you both stay on track with your finances.

- Be realistic. The quickest way to burnout is not leaving yourself some leniency. Creating a monthly budget helps you find places where there’s a little extra money to treat yourself sometimes. Allocating a few extra bucks each month for a day trip, nice dinner, or clothing purchase can keep you happy and on track. Finally, personalize your budget to fit your needs. For example, if your morning routine includes buying yourself a coffee, create a budget that ensures you can still enjoy that simple pleasure.

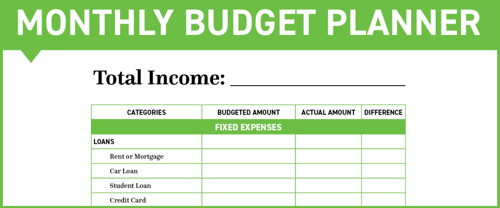

- Avoid Budget Burnout with a Savings Account from Members 1st. Avoiding budget burnout comes down to changing your financial routine and mindset. Routine changes are challenging – think about changing your workout routine. Download our budget planner to help you stay on task. Having trouble learning how to stay on budget? Don’t hesitate to reach out to our team with any money management questions.