How to Do a Biweekly Money Saving Challenge

Minute Read

Start a habit you can stick with by timing your savings deposits to coincide with your paychecks.

Like working out or flossing, putting money into savings is a habit that demands discipline. The more you practice putting money away, the easier it becomes until it’s almost second nature. A biweekly saving challenge offers a fantastic way to make savings part of your routine by timing it to your paycheck.

How a Biweekly Money Saving Challenge Works

The challenge starts small and slowly increases the figure you put away every two weeks. As you go, the amount you save grows bigger and bigger. The best part is, since you begin with a relatively modest sum (about what you would pay for a takeout cup of coffee), you can ease into the challenge and slowly adjust your budget to accomplish your financial goals.

Here’s What It Looks Like

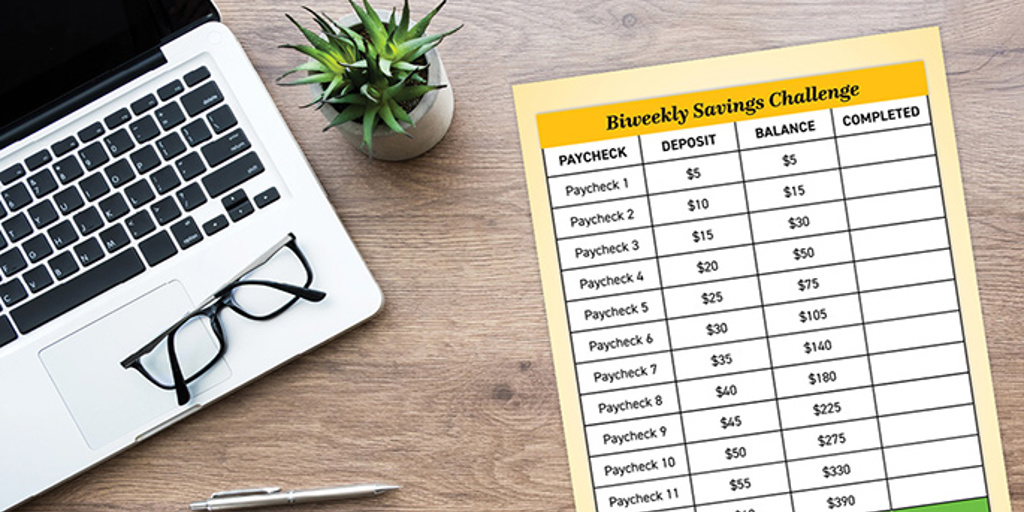

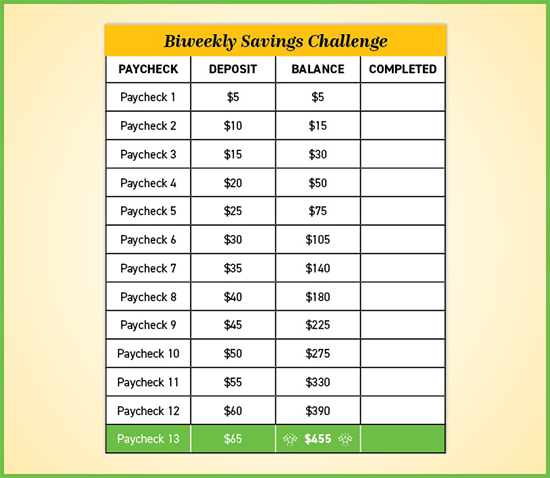

Many people start with a low number, bumping up each week by $5 increments. Your biweekly savings would look like this:

- First two weeks: $5

- Second two weeks: $10

- Third two weeks: $15

- Fourth two weeks: $20

And so on, until you reach the 13th pay period and hit $455. Throughout your one-year challenge, you would bank $1,655.

Who Would a Biweekly Savings Challenge Benefit?

Biweekly savings challenges work best for those who want to develop a savings habit or have a specific goal in mind. For instance, perhaps you already contribute to an emergency fund but also want to save with a vacation club account to avoid using your credit card for hotels and racking up debt. A savings challenge lets you build slowly into your new habit.

You might also enjoy this approach if you have tried other challenges, like a no-spend challenge, and enjoyed how they keep you motivated. They let you change your habits gradually and implement strategies to go from spender to saver.

How To Set Yourself Up for Success

Are you ready to undertake a biweekly saving challenge? Use our tips to prepare.

- Write down your biweekly totals for the entire year so that you know how much to save each pay period.

- Set up an automatic savings plan using our digital banking tools so that you can save money without thinking about it every paycheck.

- Stay motivated by revisiting your goals. Look at photos of where you want to vacation or read more about the benefits of long-term savings.

- Download our free printable money saving challenge template to help guide you on your savings journey.

Finally, find a savings account that suits your goals to reap the most significant benefit from the money you save during your challenge.