Steps After a Visa Balance Transfer is Complete

Minute Read

So, you’ve completed a Visa Balance Transfer (VBT). Congratulations! You’ve embarked on your debt-free journey, but it's not over yet. To reap the rewards from your VBT, you must follow five critical steps to get rid of your debt.

What is a VBT?

A VBT allows you to transfer a high-interest credit card balance to a Visa with a promotional rate that stays low for a limited window. For instance, the credit card balance transfer may have a 0% interest rate for 12 months. The interest rate rises if you have not paid off that balance when the promotional period expires. Learn how to do a balance transfer.

Why a VBT Is a Good Idea

Balance transfers can consolidate debt and decrease interest payments, so you can wipe out your debt faster and put more money into savings or emergency accounts.

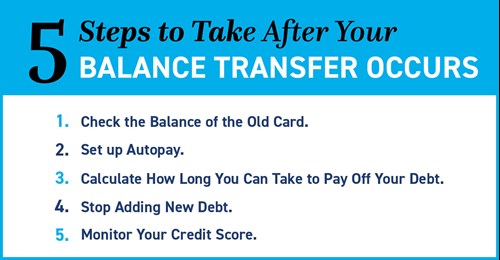

Key Steps to Take After Your Balance Transfer Occurs

Take these five steps to take advantage of all the benefits of a VBT.

- Check the Balance of the Old Card

You might assume your balance is $0 after a balance transfer, but sometimes late interest fees or expenses will go on the card in the next billing cycle. Monitor your balance for several months. - Set up Autopay

Promotional deals may end or adjust with a missed payment. Set up an automatic payment for the minimum required monthly payment so you always remember. - Calculate How Long You Can Take to Pay Off Your Debt

Paying your transferred balance within the promotional period is wise to take advantage of the low-interest rate. Figure out a plan. For instance, if you have a balance of $6,000 and your promotional rate lasts for 12 months, then you must pay $500 per month to knock out the balance in time. You might even try saving on every day costs or picking up a side hustle and funnel the extra money toward those payments. Avoid these five mistakes when paying off debt. - Stop Adding New Debt

Try not to pile up new credit card charges while working to pay off your recent balance transfer. Take these steps to help manage your credit card debt. - Monitor Your Credit Score

Regularly paying down debt can raise your credit score, regardless of income level.

Our VBT Options

We have several promotional rates available on our Visa Balance Transfers:

- A 0% annual percentage rate (APR) for 12 billing cycles*.

- A 1.9% APR for six billing cycles*.

- A 2.99% APR for three billing cycles*.

*After the promotional window, your APR will rise to 13.50%-18.00% based on your credit history.

Who Should Do a VBT?

People with a decent credit score and a high balance on their current card.

We offer many tools to make your VBT a success! Wondering how to transfer a credit card balance and face your debt? Use our debt-to-income ratio calculator to manage your debt load and our debt consolidation calculator to explore solutions. Set up automated payments with our our digital banking tools, too.