CONVENIENCE WHEN & WHERE YOU NEED IT

Online Banking

Whether you need to send money, transfer funds, set up alerts or complete everyday transactions, online banking has it all. Check balances, pay bills, order checks and more.

Learn More

Mobile Banking

Track your goals, get advice, and manage your funds from your favorite device—all at your convenience. Take advantage of features like card controls, bill pay, mobile deposit and more.

Learn More

Transfer Funds

Need to transfer money from home? Use our app to easily transfer funds to other accounts, loans, and Visa products and more. You can even make cross-account transfers, too.

Learn More

Mobile Deposit

Have a check you need to deposit but can't make it to a branch? No problem. With mobile deposit, you can deposit your checks from your phone anywhere, anytime.

Learn More

Direct Deposit

Direct deposit lets your paycheck, pension, annuity check, or Social Security benefit be automatically credited toward your account. Ask your employer for more information.

Learn More

eStatements

Say goodbye to paper statements taking over your office. eStatements ensure you get your statements on time and in your inbox instead of your mailbox. Did we mention they're free?

Learn More

Pay Bills

Tired of trying to keep track of all those monthly expenses? Schedule your bills ahead of time with our Pay Bills service and say goodbye to late payments.

Learn More

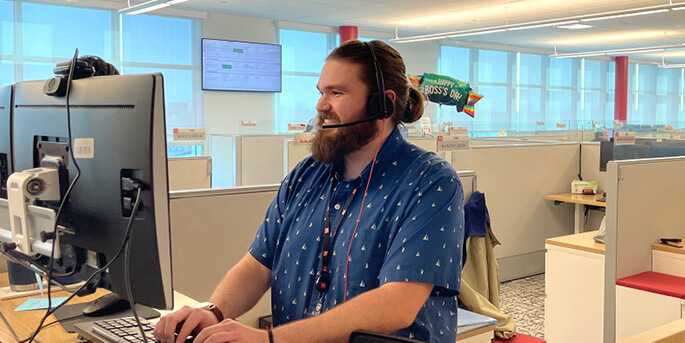

Concierge Service

Have questions? Good thing you have MyConcierge™. Half personal sidekick, half financial wizard, your concierge knows money management like the back of their hand. Best of all, they're always ready to help.

Learn More

Rewards for Loyal Members

When we see a chance to give back to our members, we take it. Our Loyalty Rewards Program allows us to provide fewer fees, more free services and so much more.

Learn More

Resources

Digital Banking Tools to Simplify Your Life

Simplify your finances with easy, secure digital banking tools that help you manage money anytime, anywhere.

Read More

4 Financial Tips for a Stress-Free Vacation

Sand, sun and relaxation? Count us in! There is no room for stress or frustration on your trip.

Read More

Top 5 Questions the Contact Center Receives: Asked and Answered

We sat down with our Contact Center team to learn the most common questions you are asking. Check out our top FAQs and how our digital banking services can help you answer these questions. Question 1:

Read More

Common Questions

Using our digital banking services, you can see all the balances on your accounts. These balances are in real time, which means you can see the exact balance that our representatives can see in Customer Service.

When you select your account in digital banking, there is a pending activity section. This allows you to see any deposits or withdrawals that will soon be posted to your account within the coming days. If a Customer Service representative can see it, then it is showing on your side of digital banking too.

Our credit union has one routing number that members use for any direct deposits or payments. The routing number is 231382241.

Your Member ID is the number you were given when your membership with Members 1st was established. This can be found on your Member ID card sent to you in the welcome packet and on the app under the "My Profile" page.

Your checking account number and savings account number can be found by:

- Signing in to Members 1st Online banking and going to the Accounts page.

- Click the share product (checking, savings, etc.) where you would like to receive the deposit.

- Your checking or savings account number and Member ID for direct deposit will be displayed at the top of the page.

Still have questions?

We're here to help you find answers. Give us a call or stop by your nearest branch.