we are available by phone

Fraud & Security Team

Fraud

Visa Debit & ATM Cards:

(800) 826-4314

Visa Credit Cards:

(800) 826-4314

Identity Theft & Other Fraud:

(800) 826-4314

Investment Services & Wealth Management

Carlisle area: (717) 249-0795

Enola area: (717) 458-6268

Dillsburg area: (717) 638-1207

Harrisburg area: (717) 638-1207

Mechanicsburg area: (717) 795-6051

York area: (717) 458-6808

CONVENIENCE WHEN & WHERE YOU NEED IT

Online Banking

Whether you need to transfer funds, set up alerts, or complete everyday transactions, online banking has it all. Check balances, pay bills, order checks and more.

Learn More

Mobile Banking

Track your goals, get advice, and manage your funds from your favorite device—all at your convenience. Take advantage of features like card controls, bill pay, mobile deposit and more.

Learn More

Transfer Money

Need to transfer money from home? Use our app to easily transfer funds to other accounts, loans, and Visa products and more. You can even make cross-account transfers, too.

Learn More

Mobile Deposit

Have a check you need to deposit but can't make it to a branch? No problem. With mobile deposit, you can deposit your checks from your phone anywhere, anytime.

Learn More

Borrow Money

Need to borrow money? Let's create a personalized plan that works for you—with terms and rates tailored to fit your budget. No prepayment penalties. No surprises. And friendly concierge service whenever you need a hand. That's just how we treat our members.

View All

Open an account

When you open an account with Members 1st, you become part of something much bigger than a credit union. You become part of our family—a tight-knit bunch with big dreams and even bigger values. Becoming a member is far easier than you imagine, and we've got a number of flexible ways to get started.

Become a MemberResources

3 Ways to De-Stress and Enjoy Vacation

Sand, sun and relaxation? Count us in! There is no room for stress or frustration on your trip.

Read More

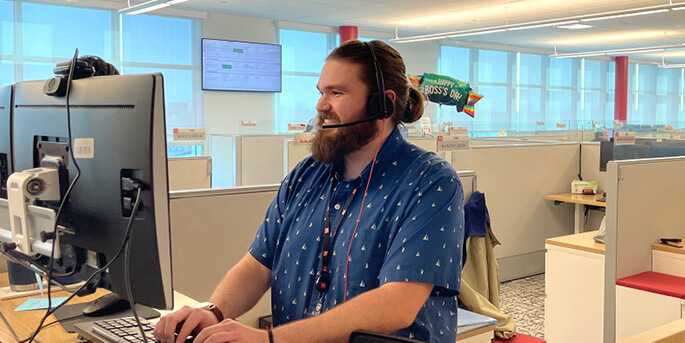

Top 5 Questions the Contact Center Receives: Asked and Answered

We sat down with our Contact Center team to learn the most common questions you are asking. Check out our top FAQs and how our digital banking services can help you answer these questions. Question 1:

Read More

8 Reasons Why You Need Mobile Banking

Online banking has become increasingly popular over the last few years—and for good reason.

Read More

Common questions

Using our digital banking services, you can see all the balances on your accounts. These balances are in real time, which means you can see the exact balance that our representatives can see in Customer Service.

When you select your account in digital banking, there is a pending activity section. This allows you to see any deposits or withdrawals that will soon be posted to your account within the coming days. If a Customer Service representative can see it, then it is showing on your side of digital banking too.

Our credit union has one routing number that members use for any direct deposits or payments. The routing number is 231382241.